Factor investing, once confined to hedge funds and institutional investors, is now gaining attention among Indian retail investors. But is this strategy practical for individuals with limited capital and access to data? In this blog, we’ll explore what factor investing is, how it works, and whether retail investors in India can adopt it effectively.

1. What is Factor Investing?

At its core, factor investing involves selecting stocks based on quantifiable attributes—called factors—that are proven to drive returns. The most widely recognized factors include:

- Value: Buying undervalued stocks (low P/E, low P/B).

- Momentum: Investing in stocks with strong recent performance.

- Quality: Picking financially sound companies with high ROE and low debt.

- Low Volatility: Focusing on stable stocks with less price fluctuation.

- Size: Preferring small and mid-cap stocks, which historically offer higher returns.

2. Why Are Factors Important?

Most mutual fund managers unknowingly tilt toward certain factors—like value or quality—when selecting stocks. Factor investing brings transparency by systematically capturing these drivers of return, instead of relying solely on subjective judgment or market sentiment.

3. Is Factor Investing Practical for Retail Investors in India?

Challenges:

Data Accessibility

Institutional investors have access to point-in-time, clean, and extensive datasets. Retail investors often rely on free platforms like Screener.in, Moneycontrol, or NSE, which can lack depth or suffer from survivorship bias.

Execution Costs

Building a factor-based portfolio (e.g., 20–30 stocks) requires regular rebalancing, which incurs brokerage fees, STT, and taxes, eating into returns.

Skill and Infrastructure

Factor investing involves coding backtests, ranking stocks, and ensuring no look-ahead bias. Most retail investors lack the tools or expertise to do this correctly.

Regulatory and Product Limitations

In India, there are few low-cost Smart Beta ETFs or ready-made factor products compared to developed markets like the US.

Opportunities:

Growing Access to Tools

Platforms like smallcase and NSE/BSE Smart Beta indices are bringing factor-based portfolios to retail investors.

Transparency and Rules-Based Approach

Factors remove emotional biases. Retail investors benefit from a disciplined strategy rather than chasing stock tips.

Better Risk-Adjusted Returns

Well-known factors like momentum and low volatility have shown outperformance in Indian markets. For example, Nifty 200 Momentum 30 Index has outperformed Nifty 50 in multiple timeframes.

4. How Can Indian Retail Investors Start with Factor Investing?

Option A: Smart Beta ETFs

- ETFs like ICICI Prudential Nifty Low Vol 30 or Nippon India Momentum ETF provide factor exposure at low cost.

- Suitable for investors who want simple, low-maintenance factor investing.

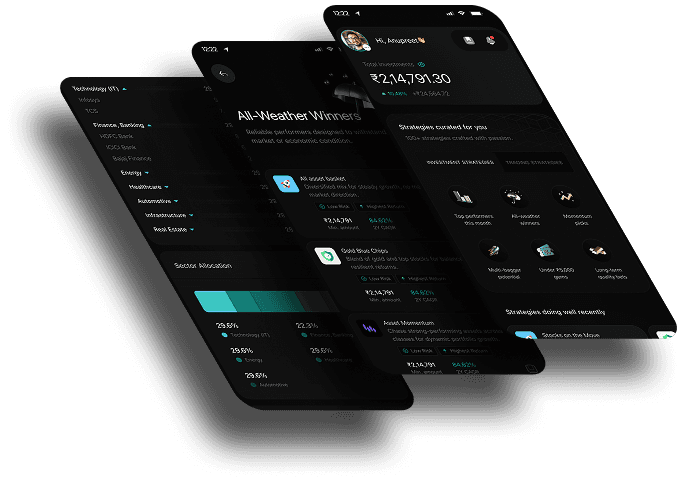

Option B: LevUp Strategies

- Levup.in offers curated factor portfolios (e.g., value-based or momentum-based).

- A hands-off way for retail investors to access factor strategies.

Option C: DIY Factor Portfolios

- Using free screeners or Python tools, investors can create their own rules-based portfolios:

- Value Portfolio: Top 20 Nifty 500 stocks by lowest P/E and P/B.

- Momentum Portfolio: Top 20 stocks by 6–12 month returns.

5. Evidence of Factor Performance in India

Research on Indian markets shows that:

- Momentum has delivered an annualized premium of 8–12% over the Nifty 50.

- Quality has provided downside protection, particularly during volatile phases.

- Value factors have had mixed results, with long drawdowns (e.g., 2010–2020), but still outperform in certain regimes.

6. Pros and Cons for Retail Investors

Pros:

- Transparent and systematic approach.

- Low emotional bias and better risk-adjusted returns.

- Growing access to tools like ETFs and smallcases.

Cons:

- Costs (taxes, brokerage) can reduce returns in DIY setups.

- Requires basic quantitative skills for custom strategies.

- Limited Indian factor ETFs compared to global markets.

7. Is It Practical? Our Verdict

Yes—but with caveats.

Factor investing can be practical for Indian retail investors if they stick to low-cost Smart Beta ETFs or curated portfolios rather than attempting complex DIY models without proper data or tools. As the Indian market matures and factor products expand, retail investors will have greater opportunities to benefit from this approach.

8. Final Thoughts

Factor investing isn’t a silver bullet. It requires patience, discipline, and a clear understanding that no single factor will outperform at all times. A multi-factor approach—combining value, quality, and momentum—offers the best long-term potential.