Global quant powerhouses like AQR Capital Management and Two Sigma have revolutionized investing by blending data, technology, and rigorous research. While these firms manage billions of dollars using advanced models and alternative data, the core principles of their success are surprisingly simple and timeless—principles that Indian retail and institutional investors can learn from.

In this blog, we’ll explore what makes AQR and Two Sigma successful, and how Indian investors can apply these lessons to their portfolios.

1. Who Are AQR and Two Sigma?

- AQR (Applied Quantitative Research)

Founded by Cliff Asness, AQR is one of the most renowned factor-based investment firms in the world. It popularized strategies around value, momentum, quality, and defensive factors, proving that a rules-based approach can consistently deliver alpha. - Two Sigma

A technology-driven hedge fund, Two Sigma combines machine learning, big data, and AI to identify patterns in global markets. They explore alternative data sources like weather patterns, satellite images, and web traffic to build trading models.

2. Key Lessons from Quant Giants

Lesson 1: Data > Opinions

AQR and Two Sigma don’t rely on gut feeling or market predictions. Their edge comes from collecting, cleaning, and analyzing data to uncover repeatable patterns.

Action for Indian Investors:

- Use rules and data when evaluating stocks (e.g., low P/E for value or 6-month return strength for momentum).

- Free tools like Screener.in, Tijori Finance, or NSE data can help build simple factor-based screens.

Lesson 2: Diversification Across Factors

AQR blends value, momentum, quality, and low volatility factors, knowing that no single factor works all the time. This multi-factor approach reduces drawdowns and improves long-term consistency.

Action for Indian Investors:

- Combine factors instead of betting on one.

- For example, create a multi-factor basket that balances low P/E stocks (value) with high ROE stocks (quality) and trending stocks (momentum).

Lesson 3: Embrace Technology and Automation

Two Sigma thrives because it automates trade execution, research, and portfolio management. They build algorithms that adapt faster than human traders.

Action for Indian Investors:

- Use tools like StockEdge alerts, broker APIs, or Smallcase rebalancing features to automate portfolio updates.

- Reduce emotional decisions by sticking to predefined rules.

Lesson 4: Focus on Risk Management

Both firms view risk as the primary driver of returns. They use advanced models to control volatility, limit drawdowns, and maintain consistent exposure.

Action for Indian Investors:

- Set stop-loss rules or position-size limits.

- Ensure your portfolio isn’t overly concentrated in a single sector (a common issue in Indian retail portfolios).

Lesson 5: Continuous Research and Adaptation

Markets evolve, and so do the models of AQR and Two Sigma. They regularly test and refine strategies to avoid factor decay.

Action for Indian Investors:

- Revisit your investment approach periodically.

- If your strategy stops working, analyze whether it’s due to market regime changes (e.g., high inflation, rising rates).

3. Why Indian Investors Lag Behind

- Over-Reliance on Stock Tips: Most investors still follow news-based or social-media-driven tips rather than data.

- Lack of Structured Approach: Few retail investors build rules-based portfolios.

- Ignoring Costs and Taxes: Frequent trading without strategy often erodes returns.

4. How to Start “Thinking Like a Quant”

Start Simple: Create a small factor-based model (e.g., top 20 Nifty 500 stocks by momentum or low P/E).

Use Smart Beta ETFs: ETFs like ICICI Prudential Nifty Low Vol 30 or Nippon India Momentum ETF are great starting points.

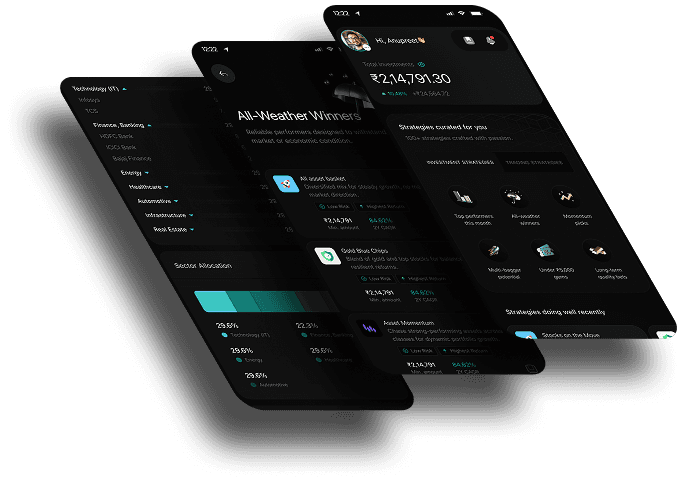

Leverage Platforms: Smallcase and other fintech tools offer curated quant strategies designed for Indian markets.

Track Performance: Use Excel or Google Sheets to monitor portfolio metrics like CAGR, drawdowns, and volatility.

5. Key Takeaways

- Data-driven strategies beat gut-based investing.

- Diversifying factors is critical to long-term success.

- Technology and discipline are as important as stock selection.

AQR and Two Sigma’s success shows that investing is as much about process and discipline as it is about picking stocks. Indian investors who adopt these principles—on a smaller scale—can create more consistent and stress-free portfolios.